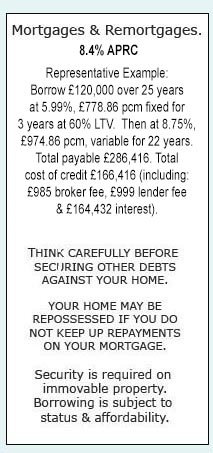

Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

. All quotes are free and without obligation so to get the facts and figures for your scenario,enquire online or you can give us a call on 0800 298 3000 (landline) / 0333 0031505 (mobile) then our in house finance advisers can assess your individual situation and see what is best for you from our options. Using a remortgage or secured loan to refinance debt means that you are moving unsecured credit to debt secured on your home, which carries the same risks as a mortgage, so think through your options carefully before going ahead.

. All quotes are free and without obligation so to get the facts and figures for your scenario,enquire online or you can give us a call on 0800 298 3000 (landline) / 0333 0031505 (mobile) then our in house finance advisers can assess your individual situation and see what is best for you from our options. Using a remortgage or secured loan to refinance debt means that you are moving unsecured credit to debt secured on your home, which carries the same risks as a mortgage, so think through your options carefully before going ahead.In some cases we are even be able to help you consolidate debt with a second mortgage as an alternative option. furthermore even If you have little equity available a consolidation mortgage could still work, we have access to remortgage plans that go up to 90% loan to value.

Credit Card Consolidation

With the recent economic crisis creating added pressure for many households, it isn`t uncommon for people to turn to credit cards, overdrafts and loans to maintain their monthly payments and insure that they don`t miss any payments. This can be an effective method if used correctly, but credit card finance should generally be restricted to a short term solution, not for sustained periods of time. If you are only making the minimum payments required for your credit cards, the debt will either stay the same or continue to rise and your short term solution might escalate into a long term problem. As the economy recovers and house prices are on the rise it may be worth considering letting your finances recover too. A consolidation mortgage could hold the key to a fresh start for your finances. Credit card debts and multiple personal loans or store cards are often the main culprits when it comes to debt consolidation, don`t be a repeat offender and use a debt consolidation remortgage to get on top of your finances. Give us a call on the above numbers and our friendly and confidential finance advisers can talk you through the mortgage and some handy lifestyle tips to keep on top of your debts. Any quotations will be provided for free and without obligation in every instance

A consolidation mortgage could hold the key to a fresh start for your finances. Credit card debts and multiple personal loans or store cards are often the main culprits when it comes to debt consolidation, don`t be a repeat offender and use a debt consolidation remortgage to get on top of your finances. Give us a call on the above numbers and our friendly and confidential finance advisers can talk you through the mortgage and some handy lifestyle tips to keep on top of your debts. Any quotations will be provided for free and without obligation in every instanceBenefits Of Consolidating Your Debts With A Mortgage

Credit card debts aren`t the only debts that can cause debt problems, a consolidation mortgage can clear anything from personal loans to car loans too. A consolidation mortgage is a tried and tested method with countless success stories from our customers alone, but why? We have compiled a short list of our top reasons:- Combine all of your payments into one manageable outlay

- It can bring down your monthly expenses

- It can relieve the stress of dealing with numerous creditors

- If paid on time each month as required, it can even boost your credit score

Potential Drawbacks Involved With Consolidation

As with any financial decision you must consider the potential downsides too. Not only that but if you have other options available to you, like can a family member help you or do you have savings you can use instead. A few disadvantages include:- If you extend the term you may end up paying more overall

- The new debt is being secured against your home and added to your mortgage

- This is not something you can repeat, you will need to avoid rebuilding debts up

- There will be fees associated with taking out a mortgage

Mortgage Consolidation Calculators

Whether it is for a residential debt consolidation remortgage or you are looking to consolidate through the use of a second mortgage, or perhaps you want to know what loan to value (LTV) you are at. Try out our loan and remortgage calculators or our LTV calculator to see how much equity you have and what your repayments could be. When you think you are ready to move forward with a consolidation mortgage get in touch and our advisers will start the ball rolling. If you still have some unanswered questions simply give us a call on the above numbers. Take the necessary steps towards a less debt stressed life.THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential